Spring Week [2025]: Get Accurate Preparation for Every Bank You Apply to & Land Your Internship

Spring Week [2025]: Get Accurate Preparation for Every Bank You Apply to & Land Your Internship

Every year, top banks and investment firms present Spring Insight programmes to first-year students, offering a chance to enhance their résumés and kickstart their early careers in finance.

Spring Week leads to a Summer Internship, which leads to a full-time role. It's that simple!

However, applying to multiple organizations and preparing for various assessments can be very time-consuming, especially when combined with other student responsibilities.

This is why we have developed a comprehensive, up-to-date PrepPack tailored to equip you for success in 12 leading banks and investment firms with a special bonus for a limited time only.

Spring Week Preparation saves you precious preparation time and provides the exact test simulations for each organisation with 6 months of access for only £139!

Morgan Stanley - Numerical, Verbal and Logical Reasoning tests, and Situational Judgement questionnaire provided by Aon (Cut-e)

Nomura - Numerical and Logical Reasoning tests provided by Aon (Cut-e)

BNP Paribas - Numerical and Verbal Reasoning tests provided by Aon (Cut-e)

Citi – Numerical and Logical Reasoning tests provided by Talent-Q (Korn Ferry)

UBS - Cultural Appraiser and Elements Numerical tests provided by Talent-Q (Korn Ferry)

Deutsche Bank - Situational Judgment Test, OPQ Personality Test, and General Ability tests. Provided by SHL.

Macquarie – Numerical, Verbal, and Logical Reasoning tests provided by Talent-Q (Korn Ferry)

HSBC - Cognitive Reasoning, Situational Judgment, and Ipsative questions. Provided by Cappfinity.

Jefferies – Numerical, Verbal, and Logical Reasoning tests, and situational judgement test. Provided by SHL.

Barclays – Cognitive Ability, Personality assessment, and mindset assessment tests. Provided by SHL.

Blackstone – Gamified Cognitive, Social, and Behavioural assessment. Provided by Pymetrics.

Standard Chartered – Gamified Cognitive, Social, and Behavioural assessment, Provided by Pymetrics, and a Valued behaviours Assessment, provided by SHL.

Bonus: Pre-recorded interview interactive guide to help you ace your upcoming HV assessment!

Full accurate Preparation Packs for the following banks:

- HSBC

- Morgan Stanley

- Deutsche Bank

- UBS

- Citi

- BNP Paribas

- Nomura (note: MotionChallenge is not included)

- Macquarie Group

- Jefferies

- Barclays

- Blackstone

- Standard Chartered

- Pre-recorded Interview Interactive Guide - Free Bonus!

Includes preparation for Aon (cut-e), SHL, Korn Ferry (Talent-Q), Cappfinity, Pymetrics, HireVue, and Amberjack.

This product can't be included in the Premium Membership.

✻ Prepare with Job Test Prep

- Save valuable time as we conduct thorough research on each organisation to provide you with tailored preparation, allowing you to focus solely on practising.

- Prepare specifically for the actual test you will take. Our materials are not generic; they simulate the exact test format. Each bank receives customised resources, including numerical, verbal, SJT, gamified, and personality practice tests. The questions closely resemble those used by relevant test providers such as SHL, Pymetrics, Talent Q, and Aon.

- Enhance your understanding through detailed answers, explanations, and study guides. These resources will guide you through techniques and problem-solving methods, enabling you to quickly and efficiently tackle every question.

- Improve your performance with comprehensive reports and analyses of your results. These insights allow you to identify your strengths and weaknesses, learn from your mistakes, and boost your overall score.

💡 Gain 6 months of access to our constantly updated Spring Week Preparation, featuring accurate test simulations for 12 organisation, all for just £139!

Note: If the bank you apply to is not on the list, please email us.

Table of Contents

- Is It Hard to Get a Spring Internship?

- Get Accurate Preparation for Every Bank You Apply To

- Spring Week Online Tests – Sample Questions (With Solutions)

- How to Ace the Spring Week Tests and Get a High Score

- Pre-Recorded Interview

- What Is Spring Week?

- When Does Spring Insight Happens, and Is It Really a Week?

- Why Spring Insights Are So Important?

- When to Apply for Spring Insights?

- Which Investment Banks Have Spring Insight Programmes?

- Conclusion

- FAQ

Is It Hard to Get a Spring Internship?

Short answer – yes.

Getting a Spring Insight is as challenging as securing any position in the competitive investment banking industry.

Let’s look at the numbers.

- BB banks receive around 6,000 applications per year.

- However, they are offering only around 60 positions - not a good ratio.

And this is for the big banks. The smaller ones offer even less, even though they don’t necessarily get fewer applications. Which makes it that much harder to get in.

Tip: Some banks offer off-cycle insight programmes. The value is the same and so is the screening process, but the number of applicants might be lower. Hence, they can be a bit less competitive. This is also a good option if you missed your Spring Week deadlines.

Because the banks have a lot of applicants, they use online tests and assessment centres to eliminate a large portion of them. Which means that if you don’t get a high score, they will not even look at your application.

How high? Well, Morgan Stanley only looks at applicants that score in the 90th percentile. Yes, you read that correctly!

The only way to secure a spring internship and outshine the competition is by excelling in your banking assessment tests.

Let’s see how.

Get Accurate Preparation for Every Bank You Apply To

If you apply to several banks, which you should, then you will probably encounter at least one of these tests:

- Numerical Reasoning

- Verbal Reasoning

- Logical Reasoning

- Situational Judgment

While the basic idea of each test is roughly the same for every bank, the question types might be very different, depending on the test provider.

Most banks use these 5 major test providers:

To get you ready for ALL major banks, we have created this preparation pack.

It includes practice questions, guides, and explanations for each of the 5 major test providers, and for the assessment centres. Which means that this pack has got you covered even if you apply to several banks in the next month.

Get a Head Start Over Your Competition

Prepare to apply for ALL leading banks with our tailor-made PrepPack.

Get access to guides, explanations and practice questions mirroring those of the 5 major test providers, such as AON and Talent Q.

🔍Taking Multiple Finance Tests?

HSBC | UBS | Bain & Co | Macquarie | Morgan Stanley | EIB | Deloitte | Deutsche Bank | Barclays | KPMG | PWC | Lazard | EY | Nomura | BCG | BNP Paribas | Jefferies | Moelis & Co | Job Simulation | Pre-recorded Video Interview | HireVue Interview

Bundles: Summer Internship | Big 4

JobTestPrep Spring Week Internships Preparation By Test Provider:

*For more information about the assessment of a specific Bank, please click on the suitable link in the table below.

| ✻ Aon (cut-e) | |

| ✻ Cappfinity | |

| ✻ Talen-Q/Korn Ferry | |

| ✻ SHL | |

| ✻ Pymetrics |

We designed our PrepPack to equip you for success in 12 leading banks and finance firms. Tailored specifically for each organisation, our materials feature test providers-style questions, including SJT, gamified exercises, personality practice tests, and assessments from SHL, Cappfinity, Talent Q (Korn Ferry), Aon (cut-e), and Pymetrics Games.

Be Prepared for Every Scenario

Access our industry-leading PrepPack™ and stay ahead of the competition for only £139

Spring Week Online Tests – Sample Questions (With Solutions)

Numerical Reasoning Test

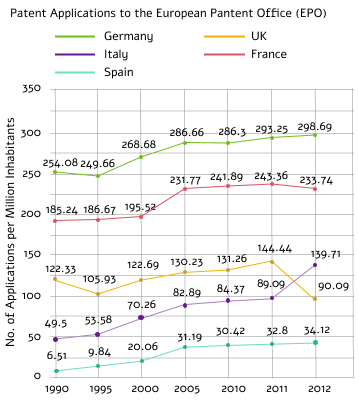

Since banking is a numbers game, the most popular test used by banks is the Numerical Reasoning. The emphasis would be the ability to read charts and tables and analyze the data quickly and efficiently.

Numerical Reasoning Sample Question

In 1990 the population of France was 56.5 million people. Since then, it has been growing at a 0.4% rate per year. Approximately how many more/less applications were submitted in France in 2012 than in 2010?

Note: These questions have a lot of data, not all of it is relevant to the answer. To answer quickly, you need to learn a technique that will help you sort out all the data and beat the clock. You can find this technique and many others in our full preparation pack.

Logical Reasoning Test

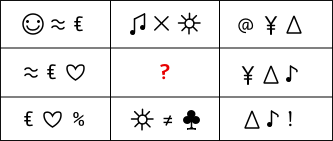

The most popular type of Logical Reasoning questions is the logical sequence. Again, this is designed to test your analytical skills and to see how you can cope with new details that you have never seen before.

Let’s see how a question like this might look like:

Logical Reasoning Sample Question

Find the answer that completes the logical sequence matrix correctly.

Note: Symbol questions like this have patterns that are used over and over again. The trick is to know how to identify the pattern quickly. For example, let’s look at the sample question. The fact that in each column there is a diagonal line of identical symbols (‘€’ in the left column and ‘∆’ in the right column) serves as a hint to indicate that this is a “movement of a sequence of symbols” question. Techniques like this are offered in our preparation pack.

Situational Judgment Test

This test is designed to evaluate your personality regarding the work environment. It seems there are no wrong or right answers, but actually – there are.

Let’s see it in an example:

Situational Judgment Sample Question

You have recently started your internship in a global law firm headquartered in London. You have just finished writing a long and tedious report that is going to be delivered to your office manager. Martin, a more experienced and well-respected intern from your office, tells you that he thinks it is possible to improve your report by making some alterations in a few sections.

What would you do in this situation?

Rank TWO of the following options, one as the BEST and one as the WORST.

- Thank Martin politely for his suggestions but leave the report as it is since you trust your own judgement.

- Discuss the suggested changes with Martin and try to understand the reasoning behind each of them.

- Make some of the changes Martin has suggested but retain the core elements that you think work best.

- Make all the changes Martin offered, trusting his greater experience.

So, what do you think?

Note: The hard thing with this type of questions is its weird structure. Marking two answers is not something you got used to in your school days. Practising makes you familiar with different types of questions. It will reduce the stress and help you perform much better.

Excel Every Question

Face your Spring Week assessment tests with ease and begin the journey to your dream job using our updated, tailored PrepPack. Ensure you're prepared with questions in the style of SHL, Talent Q, Pymetrics, and Aon. Only £139 for 6 months!

How to Ace the Spring Week Tests and Get a High Score

As you have seen in the examples above, none of these tests present very hard questions.

The problem starts with the time limit.

You will have very little time to answer a lot of questions, and it can get very stressful. Imagine you have only 30 seconds to answer a numerical question. Or 50 seconds for a logical question. Not that easy anymore, is it?

The best way to ace the tests is to practise. Talk to your alumni, to your 2nd and 3rd year, they will tell you the same. I can’t stress enough how this is the safest way to get it right. Even if you over do it and the test will be easy, you will be glad you did it once you get invited for an interview.

Practice ensures:

- No Surprises – Familiarize yourself with all question types and reduce stress

- Speed – Know how to answer very quickly and beat the time limit

- Full Coverage – Know how to ace the tests for ALL the important banks and financial firms.

Many finance graduates are also interested in accountancy firms.

If you are one of these graduates, check out our Big 4 bundle, which features practise for EY, KPMG, Deloitte, and PwC, including online immersive assessments, job simulations, and an Arctic Shores Games simulation.

Pre-recorded Interview

A pre-recorded interview, also known as a one-way video interview, is a common tool used by major banks and financial firms like BNP Paribas, Morgan Stanley, Standard Chartered, and Deutsche Bank.

This interview method evaluates job-related competencies, personality traits, and behavioural tendencies by requiring candidates to respond to work-related questions or tasks. There is no direct interaction with the recruiter, and candidates address questions or tasks on camera.

In the pre-recorded interview, you typically have up to two minutes to prepare each answer and up to three minutes to record it. The number of questions varies but usually falls between 5 to 8, taking around 20-30 minutes to complete. These questions are tailored to the specific programme you applied for to determine that you have the relevant skills. Some pre-recorded interviews also include job simulation tasks, such as case studies and situational judgment tests.

You can access these interviews through online platforms like HireVue, Cappfinity, and amberjack, or you may be asked to record your responses using your own devices. Your recruiters will review your recordings to decide whether you proceed to the next recruitment stage.

It's important to note that pre-recorded interviews often complement traditional in-person interviews rather than replace them.

Come Prepared for Your Pre Recorded Interview

We've created an interactive Video Interview Guide that simulates actual pre-recorded interview questions and answering tips, providing you with all the information you need to ace your interview!

Looking for information about Spring Insight? Let’s dive in.

What Is Spring Week?

Spring Weeks are internship programmes offered to 1st-year students in a 3-year course, or 2nd year students in a 4-year course.

Note: If you are a 2nd year student in a 3-year course, you can also apply! Go to the FAQ section at the end of the guide to understand how.

Spring Insights are usually offered by all BB banks (Bulge Bracket banks), and some smaller or boutique banks as well. All programmes are taking place in London, while some offer additional programmes in locations like Glasgow or Frankfurt.

Depending on the bank, some internships are generalist, which means that you will go through different divisions, while others are divisional, which means you will spend your time only in one division.

During the programme you will get a chance to experience what it is to work in a big bank and network with industry people. You will be shadowing employees of the bank and see exactly what their day looks like. Exciting stuff!

When Does Spring Insight Happens, and Is It Really a Week?

As the name suggests, the Spring Week usually takes place in April, around the easter holiday.

Because this programme is designed for students, it is aligned with the academic year schedule. Easter holiday is the perfect timing to get the students while they are free from university duties.

Note: some banks will offer off-cycle insight internships. Those can take place any time other than spring, and are a good solution if you missed the Spring Week deadlines.

The programmes mostly last between 4 and 7 days, in some cases they can even stretch to a full two weeks.

One week seems short, doesn’t it? Well, not quite…

As short as they are, spring weeks are VERY IMPORTANT. Here is why.

Why Spring Insights Are So Important?

This is the equation that has become the standard for investment banking career.

Is it the only way? Of course not, but you can’t deny that every year more and more candidates go through this process.

Let’s break it down and understand how it has come to be this way.

Banks Internships History in a Nutshell

Investment Banking is a HIGHLY COMPETITIVE field, with some arguing that it is the hardest field to get into. Especially when you are looking at the BB banks, which are obviously the most desired places to get into.

These banks know how competitive it can get, so they decided to start screening and looking at good candidates early on. How did they do that? Summer internships for students. If they perform well and impress whomever needs impressing, they are offered a full-time job. WIN!

Nowadays, the wildest dream for any student is to land the summer internship. They know it will improve their chances to get a job offer, as external hiring is becoming more and more scarce.

This is why summer internships have become very competitive, and the chances of landing one in a desired BB bank are plummeting every year. Again, banks know this, which led them to start screening good candidates even earlier. Hence, Spring Week (or off-cycle insight internship).

Tip: to raise your chances of getting a Spring Week offer, apply to several banks. If you get in more than one – great! It is recommended to go to as many SW as you possibly can.

Spring Insight Will Fast-Track You to a Summer Internship

Getting a summer internship without a SW on your resume is possible, but it’s getting much more difficult. The same way banks first look at summer internships to hire full-timers, they are first looking at SW to offer summer internships.

As you will shortly see, the application process for Spring Insight is not a walk in the park.

So, you can only imagine how long and hard it is to apply for Summer Internships.

- A successful Spring Week will fast-track you straight to the last step of the application process for summer internship.

- Even more than that, if you excel, they will offer you a summer internship position on the spot! With no extra screening at all.

Imagine how crazy it is to secure a summer internship in the end of your first year. Months before others even start their application process. And all because you applied successfully to a Spring Insight programme.

When to Apply for Spring Insights?

Apply as early as possible!

Let’s break it down and understand why:

- Rolling Basis – although we don’t exactly know how it works in each bank, we do know that a lot of them recruit on a rolling basis. Which basically means that they go through the applications in batches, and once they fill all their spots – they stop looking. Yeah, even if you are a top candidate that they would hate to lose.

- Competition – most of the candidates apply around November. And if we said that firms look at applicants in batches, the earlier you apply, the smaller your batch. The smaller your batch, the less the competition.

What does it mean regarding the timeline?

Most banks open for applications around September, and the deadlines go all the way up to December, sometimes January.

Note: it is different for each bank. Best if you check in the desired bank’s official site for specific dates.

Wait a minute. September? You do remember that we are talking about 1st year, yeah? My CV is still empty, no experience and even no GPA. Doesn’t make any sense!

You are right, it’s a bit tricky.

Let me put some sense into it.

How Do I Know If I Should Apply to Spring Internship Now or Later?

If you are a 2nd year in a 4-year course then you don’t have any problem. You already have a GPA, hopefully a good one. And you already have enough experience to put in your CV. That is if you prepared yourself properly for this moment. In this case, you are well advised to apply right now. Yesterday even. No point in waiting, your chances can only drop while you wait.

If you are a 1st year in a 3-year course, then you need to stop and think for a moment.

Answer me this – how does your CV look? Do you have some relevant experience to put in there?

- Yes, I have a solid CV – you should apply as early as possible.

- No, it doesn’t look very good – you are advised to wait a bit, let’s say until mid-late October. By that time, you would already start school and have time to put something down as work experience.

Which Investment Banks Have Spring Insight Programmes?

Basically, all the BB banks offer these internships, and then some.

They differ from one another in the stages of the application process, the length of the internship and whether it is general or divisional programme.

Note: the following information is an estimate based on past years. The details might change a bit.

Let’s talk about some of the major and most desired players out there.

Duration: 1 week

Includes:

3 different paths:

- Finance degree

- Non-finance degree

- Technology business

Application Process:

- CV and Cover Letter

- Phone interview

- Recorded video interview

Duration: 2 weeks

Includes:

divisional internship:

- Engineering

- Global Markets

- Investment Banking

- Legal

- Operations

During the programme you will be shadowing actual employees and work on a case study.

Application Process:

- CV

- Recorded video interview

- Phone interview

Duration: 1 week

Includes:

A general programme, in which you will visit divisions like Investment Banking, Global Capital Markets, Bank Resource Management, Sales and Trading etc.

Application Process:

- CV and Cover Letter

- Online tests: Numerical Reasoning, Logical Reasoning and Verbal Reasoning tests

- 2 phone interviews: the first is competency based, the second can be technical (case study)

Duration: 4 days

Includes:

General programme, which includes:

- Work shadowing

- Case study sessions

- Networking events

- Meet senior bankers

- Skills workshops

Application Process:

- CV

- Online tests – Numerical Reasoning and situational Judgment

- Recorded video interview

- Phone interview

Duration: 2 days

Includes:

General programme, including skill sessions and networking events.

Application Process:

- CV

- Online tests – Numerical Reasoning and Situational Judgment test

- Recorded video interview

Learn more about the UBS online assessment and application process.

Duration: 1 week

Includes:

Divisional programme which includes:

- Skills sessions such as technical training and leadership

- Training in the specific division

- Interactive online learning content

- Team integration

- Social impact projects

- Networking events

Application Process:

- CV

- Online tests – Numerical Reasoning and Situational Judgment

- Recorded video interview

Duration: 1 week

Includes:

General programme, during which you will go through several divisions. You will be shadowing each division and have networking events.

Application Process:

- CV and Cover Letter

- Online tests – situational judgment test

- 2 phone interviews

Duration: 1 week

Includes:

A divisional programme in one of the following:

- Capital Markets

- Corporate Banking

- Investment Banking

- Markets and Securities Services

- Private Bank

- Treasury and Trade Solutions

You will be shadowing in your division and attend networking events.

In your application you will be asked to rank the top 3 divisions you would like to intern in.

Application Process:

- CV and cover letter

- Numerical Reasoning online test

- Video interview

- Phone interview

Duration: 1 week

Includes:

Divisional programme in which you will be shadowing 2 lines of business of your choice.

Application Process:

- CV

- Video interview

- Phone interview

Duration: 4 days

Includes:

General programme, which includes:

- Workshops

- Work shadowing

- Case studies

Application Process:

- CV

- Online tests – Logical Reasoning test (Switch Challenge)

- Video interview

- Might be called in for an assessment center

Duration: 3 days

Includes:

Divisional programme in which you will be shadowing different employees, participate in team-building exercises, and give presentations to your peers and mentors.

Application Process:

- CV

- Online assessment –Numerical Reasoning, Logical Reasoning, and a Personality Test.

- Video Interview

Duration: 1 week

Includes:

Divisional programme in which you will be shadowing employees, participate in networking events, and give presentations.

Application Process:

- CV

- Online assessment – Numerical Reasoning, Verbal Reasoning, Logical Reasoning, Personality Test, and a Mindset Assessment.

- Video Interview

- Assessment Centre

Duration: 4 days

Includes:

A general programme in which you will interact with business and recruiting professionals and be introduced to the essential knowledge, training, and skills required to kickstart a career in real estate investment.

Application Process:

- CV and Cover Letter

- Online assessment – Pymetrics games.

- Video Interview

Duration: 4 days

Includes:

Divisional internship:

- Corporate

- Commercial

- Investment Banking

Application Process:

- CV

- Online assessment – Pymetrics games and a Valued behaviours assessment.

- Video Interview

Note: more banks are offering programmes. These are just the major ones.

Achieve Your Desired Outcome

Most major banks use online assessments. Don't get left behind.

Start practising now for ALL banks (including those not listed above).

Conclusion

The Spring Week is a very important first step into the investment banking world.

The fact that you are only starting your 1st year should not confuse you – if you don’t get at least one Spring Insight, you will stay behind!

It is quite overwhelming, but very much possible and worth the effort.

Use all the information and tips I have given you and spring into Spring Week!

Apply for a lot of banks, and practise, practise, practise .

Good luck, I believe in you!

Spring Week FAQs

Theoretically, yes, you can. But the competition is very tough, and your chances are slim. A Spring Week in your resume will go a long way. It will improve your chances greatly. Therefore, it is HIGHLY recommended to get a Spring Insight.

Yes, you should apply. It is true that a lot of candidates from target universities (ie. Oxbridge, UCL, LSE, Imperial and Warwick) are getting accepted. But they are not the only ones. If you are a strong candidate, with a good CV, a high score in the online tests and a very good interview – you will be accepted, regardless of where you attend.

Yes, you can. The only way for you to accomplish this to add a 1-year master to your course, which means you now have 3 years ahead of you. In that case, your application will be considered.

Like many companies in the economy, the banking companies also had to adapt to the unique situation the Coronavirus led. After a period of uncertainty in which internships did not occur, all training took place by remote control. Today in most companies, the internships are back to being conducted face-to-face.

Admittedly, temporary changes have become the new norm, and they are here to stay - tests and admission interviews for specializations are now carried out almost entirely digitally.

It has both a positive side and a less positive side. The downside is that the admissions tests and interviews have become much more sophisticated - for example, there are companies whose admissions process contains three different tests, and the next stage will open to you only if you pass the previous step. In addition, the lack of the human element in interviews may lead to stress, decreased performance, and failure.

The good news is that a digital screening is more predictable when illuminating the human component. Therefore, research and proper preparation can absolutely help you nail your upcoming online assessments and interviews.

It is true that the questions are easy, but remember – you have a tight time limit. If you are not well prepared you will find it is very hard to get a good score. The more you practise, the better you get. The better you get, the higher your chance to get a Spring Week.

More Free Practice

We at JobTestPrep find the assessment tests world highly diverse and fascinating. If you are looking to deepen your knowledge in the aptitude tests world, or you want some extra practice before your test, we've got you covered!

Check out these fantastic free practice tests (all are completely free):

Free Aptitude Test | Free Psychometric Test | Free Numerical Reasoning Test | Free Verbal Reasoning Test | Free Cognitive Test | Free Critical Thinking Test | Free Abstract Reasoning Test | Free Spatial Reasoning Test | Free Personality Test | Free Inductive Test | Free Mechanical Reasoning Test